This article talks about Simple Linear Regression from the scratch – From different types of regression to concepts underlying for evaluation of a model to predicting future values based on regression. The topics covered are –

- Introduction

- Some properties of Simple Linear Regression Model

- Types of Regression

- Estimating the Best Fitting Line

- Properties of Least Squares Line b0 & b1

- Statistical Properties of least square estimators (b0 & b1)

- Understanding Distributions followed by Sum of Squares of Residuals

- Evaluating Model-Test of Slope Coefficient

- Evaluating Model- ANOVA

- Which test statistic is better?

- Coefficient of Regression

- Confidence Interval of β1

- Interval Estimation of the mean response

- Prediction Interval for a New Response

Introduction

Regression is used to determine relationship between 2 set of variables. The 2 set of variables are dependent and independent variables. Dependent variable may be called as Response variable and independent variable may be referred as predictor, concomitant, controllable, explanatory, covariate variables. Dependent Variable is usually denoted by Ybar and Independent Variable is denoted by Xi, I =1 to p.

Univariate Regression Model is the one which has one dimensional dependent Variable. But if dependent Variable is a vector then we have Multivariate Regression.

Simple Regression is when we have only one independent variable. Multiple Regression is when we have multiple independent variables.

We never know what the true relationship is in between Y and Xs (Dependent and Independent variables respectively) but we assume that there is some function that defines Y in terms of Xs. However, it is very difficult to find out this function. And even if we figure out this function we shall still get different results owing to random errors (measurement limitations, model inadequacies, uncontrollable factors, missing Xs, etc). Thus the model has a deterministic part (the function defining Y in terms of Xs) and Random Noise (Errors).

While regressing Y on Xs we try to approximate the deterministic part(true unknown function f) which can be denoted by β0+ β1 X1+ β2 X2+ β3 X3+….+βp-1Xp-1, where βi s are regression coefficients or parameters. And for random error, we assume that on an average for all the Xs given and a repeated observation of Xs, the Expectation/mean of random noise is 0. This also implies that Deterministic linear model (β0+ β1 X1+ β2 X2+ β3 X3+….+βp-1Xp-1) actually represents the locus of means of Y as the set of Xs changes values over repeated observation. Hence, we can say, E (Y|X1…..Xp-1) = β0+ β1 X1+ β2 X2+ β3 X3+….+βp-1Xp-1.

Some properties of Simple Linear Regression Model

- E(Yi), at each value of the predictor, Xi, is a Linear function of the Xi

- The errors, €i, are Independent.

- The errors, €i, at each value of the predictor, Xi are normally distributed.

- The errors, €i, at each value of the predictor, Xi, have Equal variances (denoted σ2).

(Source & Reference: https://onlinecourses.science.psu.edu/stat501/node/253)

Types of Regression

- Linear Regression -We call a Regression to be Linear when Regression the βi s parameters are linear.

- First Order Regression – It is the regression where the independent variables used as regressors are not having any further deeper level of association with other variables. (Y = mX+n)

- Higher Order Regression – When the regressors are of higher degrees, let’s say Xi=Z2, Xi+1=Z and so on, then first the regression on Y is called Higher (Quadratic when second order and Cubic when third order) Order Regression. (Y = mZ+nZ2+e)

Estimating the Best Fitting Line

Scatter Plot – For given (Xi,Yi), we plot all the (X,Y) for all observations and then try to draw a best fitting line(one which passes through most of the (X,Y) points or which gives least error). There are n number of lines that can pass through these points and in order to determine which is the best fitting line we use Least Squares Estimates method.

Least Squares Estimates Method – Now, that we understand different types of regressions let us consider First Order Linear Regression Y = β0+β1X+€ to understand the Least Square Method which determines the best fitting line passing through several points plotted from the observation of (Xi,Yi).

Y = β0+β1X+€

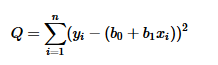

The bold underlined part represents the deterministic part/function. Through regression we can approximate some lines Y = b0+b1X, where b0 & b1 values change for different possible lines. Now, in order to figure out best fitting line, we try to approximate b0 & b1 values such that sum of squared differences between the plotted Y (Yi) values and approximated Y values (b0+b1Xi) is minimum for all observations i. That is, we try to minimize the equation below, by taking derivative with respect to b0 & b1 and then setting it to 0 to obtain b0 & b1. This process is called minimizing the sum of squared prediction errors.

This equation Q is also called as SSResiduals.

On solving these equations we get the least square estimates of b0 & b1 as-

For understanding the calculations in details please refer the following link.

https://www.youtube.com/watch?v=Z_GyV_SuFTI&index=2&list=PLLqEsfz6HOamSu7v9zBZ1IkVcCl2atzWL

b1 can also be called as Sxy/Sxx.

Interpretation of b1 is simply that when Xi increases by 1 unit Yi increases/decreases by b1*Xi.

And interpretation of b0 is average Y when Xi is zero.

Thus, Ypred= b0+b1Xi where b0 & b1 are obtained from above equations represents “least squares regression line,” or “least squares line” or “estimated regression equation.”

Properties of Least Squares Line b0 & b1

- Sum of residuals in any regression model that contains an intercept b0 is always 0.

- Sum of observed value equals sum of fitted values

- Sum of Residual value multiplied by weighted regressor value is zero.

- Sum of Residual value weighted by the fitted respondent value is zero.

Statistical Properties of least square estimators (b0 & b1)

- Both b0 & b1 are unbiased estimator of β0 & β1

- If the Xi’s are fixed, then b0 & b1 is a linear combination of the Yi’s.

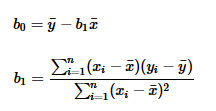

- Variance of b1 is σ2/Sxx

- Variance of b0 is σ2: {(1/n)+(xbar2/Sxx)}

- Estimation of σ2:

For details refer: https://www.youtube.com/watch?v=HcIVc7TI_z0&list=PLLqEsfz6HOamSu7v9zBZ1IkVcCl2atzWL&index=3

Understanding Distributions followed by Sum of Squares of Residuals

SSRes = ∑€i2

We know that €I follow Normal distribution with mean 0 and variance σ2 which implies that €I/σ follows N(0,1). And from the property of identically independent distributions the square of iids following normal distribution has chi squared distribution.

Therefore, (€I/ σ2) ~ ϰ12

From the least square properties discussed previously, we know that sum of all the €I is zero and Sum of Residual value multiplied by weighted regressor value is zero. Owing to these conditions on €I there are n-2 degrees of freedom for residuals. That is, there are n-2 errors terms that can be chosen independently but 2 terms have to be chosen in such a way that they follow the 2 conditions mentioned above in this paragraph.

Thus, (SSresidual/ σ2) =∑(€I/ σ2) ~ ϰn-22

This implies, {(n-2)MSresidual}/ σ2 ~ ϰn-22 where MSresidual = SSresidual/(n-2). This is useful in testing hypothesis. We will see this in detail while using ANOVA technique to evaluate the models.

Evaluating Model-Test of Slope Coefficient

This test is to show if there is a linear relationship between X and Y.

The Null Hypothesis considered here is β1 = 0 (Indicating No Linear Relationship)

And the alternate hypothesis is β1 ≠ 0 (Indicating Linear Relationship)

To test this hypothesis, we first find out the distribution followed by b1 which is an unbiased estimate of β1 i.e. mean of b1 is β1.

As seen earlier the error term follows normal distribution with mean 0 and variance σ2.

And, E (Yi) is β0+β1Xi. Thus, Yi follows N (β0+β1Xi , σ2).

From this we can say that b1 follows N (β1, σ2/Sxx) and Z = (b1– β1)/ ~ N(0,1)

Test Statistic:

Z = (b1)/ under H0: β1 = 0

If σ2 is known, we can use Z to test Null hypothesis such that we reject H0 if |Z| > Zα/2.

Usually, we do not know the σ2 and hence replace σ2 by its estimate MSResidual i.e. SSResidual/(n-2).

t = (b1– β1)/(√(MSResidual)⁄(Sxx)) ~ tn-2

Test Statistic:

t = (b1)/(√(MSResidual)⁄(Sxx)) under H0: β1 = 0

We reject H0: β1 = 0 if |t| > t α/2,n-2

Evaluating Model- ANOVA

Our model is Y = β0+β1X+€ and the fitted line is Ypred= b0+b1Xi and again the Null hypothesis is H0: β1 = 0. To solve this problem or test this null hypothesis we use Analysis of Variance technique instead of t test mentioned above.

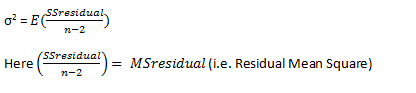

The aim of the ANOVA technique is to find out how much of the total variation of response variable is explained by the regressor variable and how much is left unexplained.

Total unexplained variation in data = ∑(Yi – Ypred)2

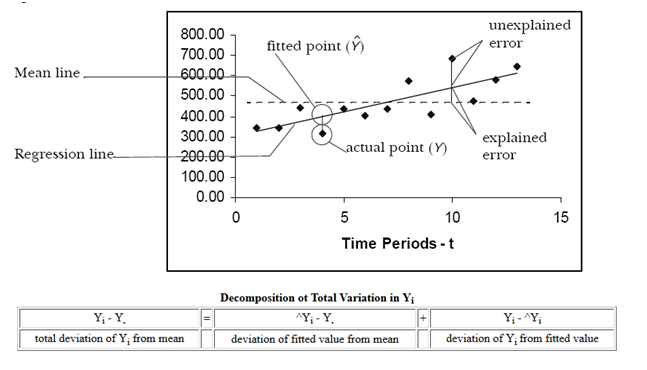

Let us replace Ypred by ^Yi and Y. denote the average of Yi for understanding following concepts.

The Variation can be decomposed as follows.

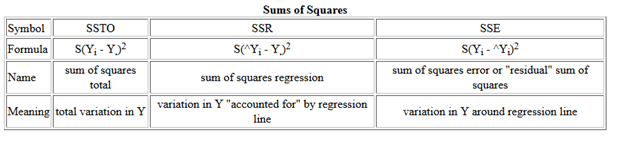

Sum of Squares, naming convention and its meaning is as denoted below.

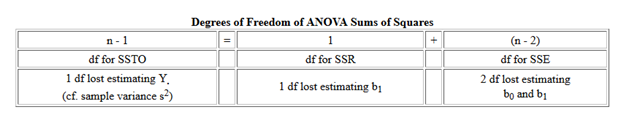

Following table represents Degrees of Freedom of different sum of squares and provides its justification.

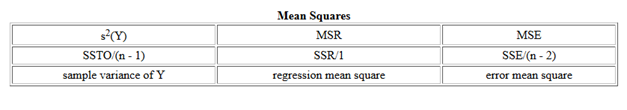

Means Squares are nothing but Sum of Squares divided by Degrees of Freedom which is given in the following table

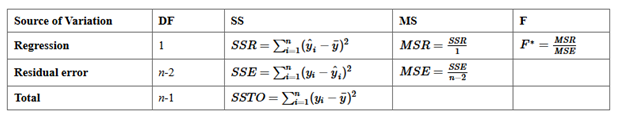

From all this, we can now create an ANOVA table –

Also, the expected value of MSR is given by

E (MSR) = σ2 + b12 ∑ (Xi – Xbar)2

And that of MSE is given by

E (MSE) = σ2

We have seen earlier that {(n-2)MSresidual}/ σ2 ~ ϰn-22 and MSReg/ σ2 ~ ϰ12 and under the H0 : β1 = 0, these two entities/distributions are independent.

From the statistical theorem, X~ ϰm2 and Y~ ϰn2 such that X and Y are independent then F = (X/m)/(Y/n) ~ Fm,n Distribution.

Thus, F = MSR/MSE follow F1,n-2 distribution.

What does F value denote?

When the F value is 1 it means MSR value is equal to MSE and hence b1 equals to zero. But if it is large then b1 is non zero indicating existence of linear relationship between dependent and independent variables.

To test the significance and the hypothesis, we compute F and reject H0: β1 = 0 if F > Fα,1,n-2.

Which test statistic is better?

While testing simple linear regression, no test is better than the other as F=t2. The results obtained are same for whichever test statistic is used for model evaluation. However, while test Multiple Linear Regression, ANOVA approach needs to be used.

Coefficient of Regression

It is defined as R2 = SSR/ SST. This is one parameter to evaluate the performance of fitted model. To further understand how use this to evaluate model refer following article.

http://thevectormachine.com/index.php/2016/09/19/assessing-linear-regression-model/

Confidence Interval of β1

The aim of confidence interval is to provide a range of b1 in which the population parameter β1 would be seen with high probability than giving a point estimate. To achieve this we first find the point estimate and then try to find the sampling distribution of that point estimate b1.

Least square estimate or point estimate of β1 is given by Sxy/Sxx.

And we have seen previously that (b1– β1)/(√(MSResidual)⁄(Sxx)) ~ tn-2.

The confidence interval of β1 is nothing but

P{ -t α/2,n-2 ≤(b1– β1)/(√(MSResidual)⁄(Sxx)) ≤ t α/2,n-2 } = 1- α

Interval Estimation of the mean response

Again to estimate the mean response interval, we first find point estimation of mean response.

That is for a given x=xh, expected value of Y is obtained. Let us denote it by E (Y|x=xh). Then we find out the sampling distribution of this expected value which comes out to be

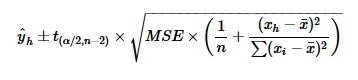

![]()

This when normalized we see that E (Y|x=xh) follows tn-2 distribution.

Thus,

100(1-α) % CI on E (Y|x=xh) is

Where y^h is the fitted or predicted value.

This CI is minimum at xi=xh . It widens as | xh – xbar| increases.

Prediction Interval for a New Response

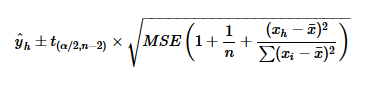

Just as we found Confidence Interval Estimation of Mean Response, we find Prediction Interval for a new response.

Where y^h is the fitted or predicted value.

Source & Reference:

https://onlinecourses.science.psu.edu/stat501/node/250

http://www.unc.edu/~nielsen/soci708/m15/m15.htm

Bahot badhiya 🙂

Thanks Zee !

One type of probabilistic model, a simple linear regression model, makes assumption that the mean value of y for a given value of x graphs as straight line and that points deviate about this line of means by a random amount equal to e, i.e.