It’s not about having the right financial answers; it’s about having the right financial abilities. Answers are about the past, and abilities are about the future.

– Robert Kiyosaki, Author of American Investor

Robert has aptly put the words that abilities to explore various financial queries are the real key to unravel the financial puzzles. Designing a BI system efficient enough to let business users explore is one such step towards providing Retail firms the necessary Financial Intelligence.

Financial Intelligence works on the same Business Intelligence approach of ‘Analyse, then Query’. The separate term is coined to indicate the domain specific detailing that are intrigued.

To be specific, Accounting is what Financial Intelligence deals with! And yes, it is little above the Revenue and Profit metrics that we deal with in our usual Retail domain’s BI analytics.

The Financial Intelligence often begins with a E- Business Suite setup that organisation has installed for various business users to note their daily financial data.

Like HR, Manufacturing, CRM, Projects, ‘Financials’ is one of the groups from the EBS suite. Each of this group is further consisting of modules.

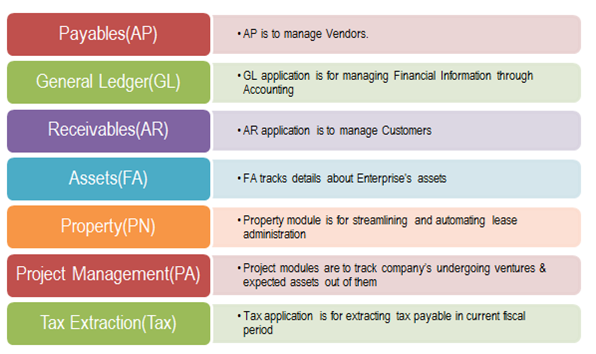

Financials Module of EBS usually has 5 main modules.

- Payables(AP)

- General Ledger(GL)

- Receivables(AR)

- Assets(FA)

- Cash Management(CM)

There are other modules as well where every module deals with a specific purpose.

On the whole, the EBS Financials links Enterprise with Customers, Vendors and Banks.

AR application is to manage Customers and likewise AP is to manage Vendors. CM Application is for supervising Bank Reconciliations. FA tracks details about Enterprise’s assets and GL application is for managing Financial Information through Accounting.

Owing to the complex structure of Financials database, designing a robust Financial Intelligence platform on it is a struggle in its own way. To reduce the efforts and brainstorming required to understand the data model of Financial ERP system, companies like Noetix came up with a view layer that simplifies the report development against ERP. Just as an example, NoetixViews for Oracle Financials includes more than 190 views covering areas such as budgets, balances, parent-child hierarchies, journal entries, suppliers, invoices and invoice aging, receivable balances, payments, customers, receipts, un-booked assets, asset assignments, depreciation particulars, cash transfers and reconciliation.

The simplified and easy to assimilate views and column names from the noetix definitely prove as a benefit for designing a real intelligence platform with MicroStrategy and Tableau like tools. The reporting incorporates the development of documents like top vendors of a period, the duplicate invoices across the entire operating unit, the asset register report to track and make an estimate of company’s profit, the tax reports to analyse the tax share for various customers and suppliers, etc. The reporting also deals with listing the accounts and associated billions & trillions of monetary amounts transacted in a given time period. Reports like Account Analysis are specifically designed to facilitate the business officials with a one glance report for checking an overall financial condition of their organization.

With all such complex reports at hand, Finance and Accounting Reconciliation becomes definitely simplified. It hence lets business users to segregate relevant financial information in no time for making effective decisions for organization’s growth.